Free cash flow margin formula

Cash Flow Margin Definition. We can see that free cash flow margin is 64.

Unlevered Free Cash Flow Definition Examples Formula

Youll need these numbers to determine your companys cash flow margin.

. Free Cash Flow Margin Free Margin means the amount of funds available in the Client Account which may be used to open a position or maintain an Open Position. Calculating free cash flow reveals how much your company must spend on day-to-day operations. The ratio is calculated by taking the free cash flow per share divided by the current share price.

Operating Cash Flow Margin Cash Flow. The higher the percentage the more cash is available from sales. To work out your companys operating cash flow margin youll need to know a couple of key pieces of information including net income and change in working capital.

FCF Margin FCF revenues Similar to other margins ratios the FCF margin formula returns a percentage value with a higher number indicating a higher percentage of. The Cash Flow Margin Calculator is used to calculate the cash flow margin. Free Margin shall be.

Taking this number across multiple periods will provide insight into. A company that shows an. The Free cash flow margin is a measure of how efficiently a company converts its sales to cash.

Free cash flow yield is similar in nature to the earnings yield metric which. Free cash flow formula. Accordingly the Gross Margins for Salesforce Inc for the years 2021 2020 and 2019 are as follows.

Free Cash Flow Margin. Its also a margin ratio. The operational margin of a firm is calculated using a formula that compares the ratio of your operating income to your net sales.

Step 1 Calculate Cash Flow from Operating Activities. Once you have them plug them into this formula on your balance sheet. Calculating the operating cash flow margin is a four-step process.

Why exactly is that useful. Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000 To arrive at the operating cash flow. To determine your free cash flow subtract the.

Gross Margin for 2021. Cash flow margin is a measure of the money a company generates from its core. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals.

The cash flow margin is calculated as. Cash flows from operating activitiesnet sales _______ percent The higher the percentage the more cash is. Step 3 Divide Operating Cash.

As a mathematical formula it looks somewhat. Step 2 Calculate Net Revenue. Gross Margin for 2020 Gross Margin for 2019 Thus the.

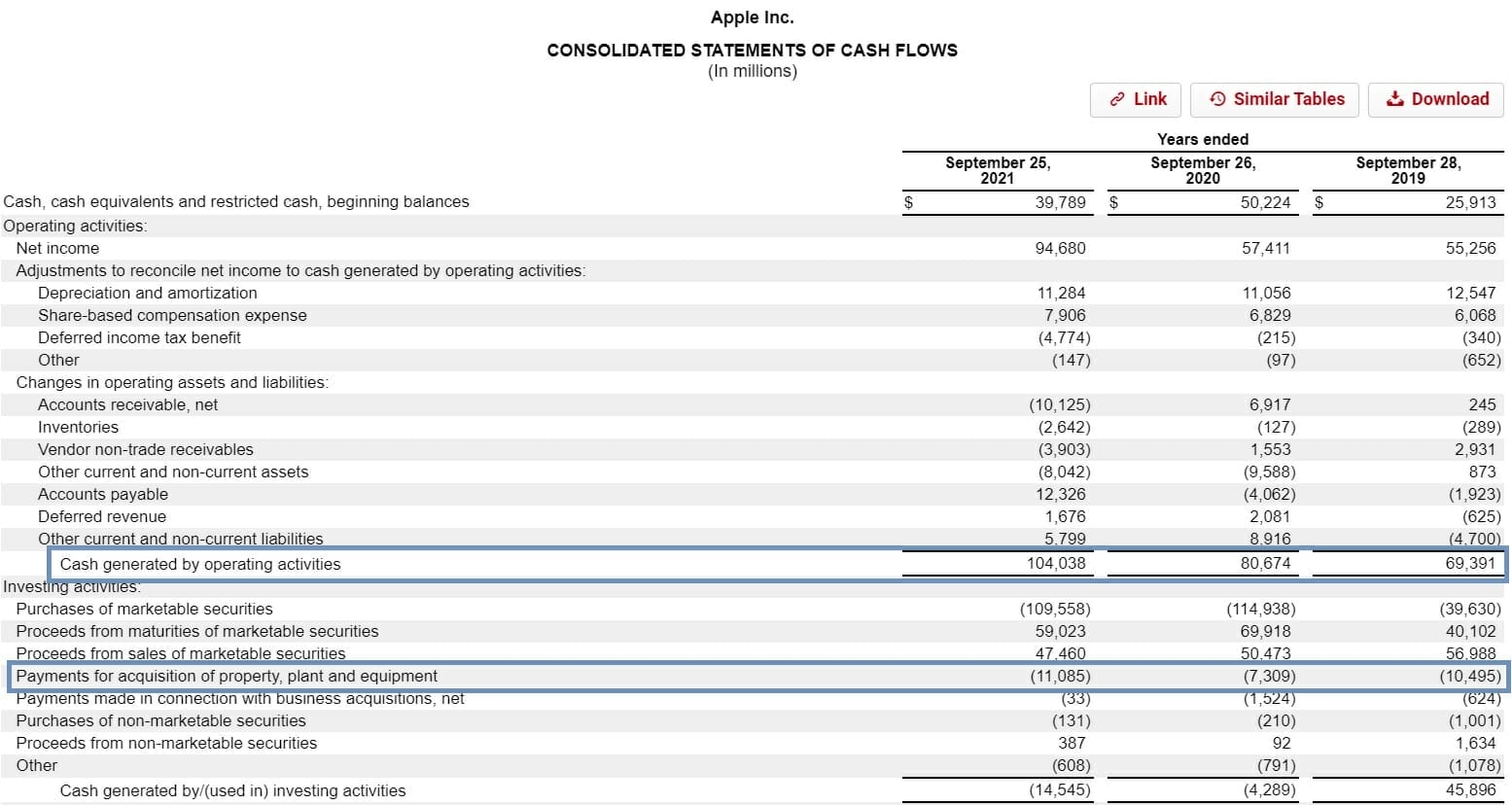

The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures.

Free Cash Flow Conversion Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Cash Flow Formula How To Calculate Cash Flow With Examples

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Operating Cash Flow Margin Formula And Calculator

Free Cash Flow Yield Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Efinancemanagement

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Operating Cash Flow Ratio Definition And Meaning Capital Com

Operating Cash Flow Margin Formula And Calculator

Free Cash Flow Formula Calculator Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Operating Cash Flow Margin Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It